Client

- Mortgage Lending Web Application

Services

- UI/ UX Design

- Dedicated Hire Team

- Product Development

- DevOps Solutions

Industry

- Mortgage

The Brief

The client is a US-based mortgage company headquartered in California. They specialize in providing Non-QM loan programs as well as a Prime Jumbo solution for their borrowers.

The Challenge

The complexities faced during the development of the client's website.

- When we began working with the client, they had a functional backend web app for loan processing that was heavily utilized by their account executives. However, they were dissatisfied with its usability and sought improvements in UI/UX and overall refinement of the application. Their ongoing collaboration depended on our ability to efficiently deliver these enhancements.

- User Management: The users and roles were tightly integrated with Byte software and it used to create permission issues frequently on the front end whenever there were changes made to the users directly from the byte software. It would make their account executives and loan officers frustrated as they got locked out of the system.

- Custom Pricing Engine: The pricing engine is crucial for any mortgage application. Since the client primarily dealt with Non QM loans, they had developed their own pricing engine in-house. This engine needed regular updates to account for market changes. However, the developer responsible for maintaining the engine was no longer available. The challenge was to fully understand the engine within a month and start supporting it seamlessly due to its critical importance.

- 1003 management and integration with byte: 1003 is an important aspect in loan processing which includes detailed historical and current data about the borrowers like personal details, residential details, employment details and could span more than 300 fields to work with. It was directly managed from Byte and used to be an offline process. The requirement was to enable the loan officers to maintain the borrowers 1003 right from the web application.

- Appraisal Management: Appraisal management was done offline before directly from Byte software. Then they partnered with a third party called Reggora that would ease their appraisal process. Appraisal management was cumbersome as there was a lot of to and fro communication between multiple authorities like loan officers, underwriters, account executives.

- Real time notifications: Multiple users would be working on the same loan at the same time and if one user would make an update on the loan then it became important to notify other users who are working on the loan about the updates.

The Solution

To handle the complexities, we utilized a mix of advanced technologies and a systematic approach:

- Our team spent a month understanding the application by having regular meetings with the stakeholders and asking questions to set the right expectations. Once the expectations were set, the team went about analyzing the design requirements and started proposing and propagating the necessary updates.

- The major concern was regarding the data table that was used to display the data in various modules. It was clunky, heavy and difficult to maintain. It was promptly replaced with a more user-friendly and intuitive angular supported data table

- We were able to streamline a single step loan application process into a more detailed 4 step process in the form of a wizard. It included integration for document management to and from Byte software, along with a chat widget to facilitate communication between the Account Executives and Loan officers.

- Additionally, the developers helped with minor bug fixes and made the application stable in a couple of months .

- The user accounts worked between the front end web app and Byte Software through 2 sync jobs. Overall the system worked fine, but on thorough analysis our developers unearthed a minor nuance which was left unaddressed and made the user accounts go out of sync when changes were made to a user account in Byte. Eventually the issue was fixed with the sync job and with a few optimization tweaks, the problem was addressed for good.

- It was very crucial for the developers to understand the inner workings of the pricing engine for them to support it efficiently with all the complexities involved. The pricing engine would get pricing for all their loan programs and included more than 100 parameters for each loan program. Few hiccups here and there, within a month they were up to speed and started to maintain, upgrade and helped with frequent crucial changes that had to be put into effect for the system to work as expected.

- Since we had to deal with so many fields, sections and conditions for 1003, we had to address problems with UI/UX by making the interface clean, intuitive and easy to use for the loan officers. All the data was managed from a single page with fields divided between clearly identifiable sections. It allowed a user to partially save the 1003 application locally and then sync with the Byte software once the application was complete.

- Appraisal management involved regular communication with the stakeholders and came up with the following solution:

It involved a user interface on the front end web application for the loan officer to submit a request for appraisal which involved a 2 step process:

Submit the appraisal request to Reggora using Reggora API

Submit the appraisal request to Byte Software using Byte API

Additionally, created a windows widget in byte software that would provide an excel sheet like feature for underwriters to manage the appraisal data that was submitted from the front end web application. - We implemented web sockets within the application that enabled us to send out real time notifications and chat functionality to the application users.

Byte Software Integration

Use Byte APIs and SDK to facilitate flow of information from the front end web application and Byte software

Appraisal Management

Enabled Appraisal management with Reggora API Integration along with Byte API and Byte Windows Application integration with the front end application.

1003 Management

Upload a 1003 file and it displays all the data in the user interface for the Account executive or Loan Officer to process. The data once processed on the front end web application is then stored to Byte.

Custom Pricing Engine

Maintain the custom pricing engine with frequent updates that gives out effective pricing for different loan programs managed by the company based on borrower data entered by the Account executive or Loan Officer.

The Results

The implementation of the website led to several meaningful results.

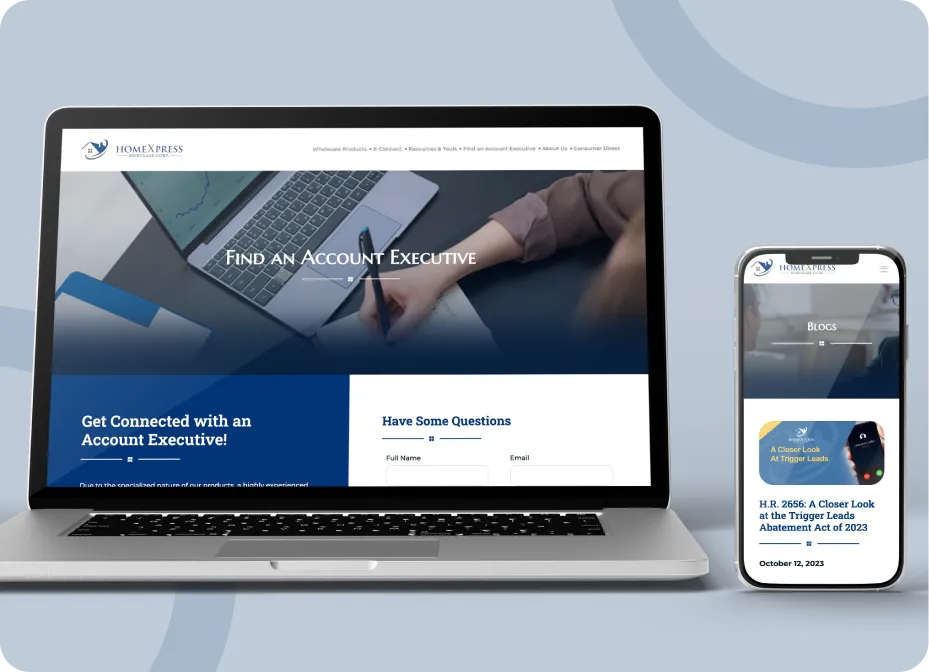

- Own end to end HomeXpress ecosystem and help maintain it.

- A robust front end web application with an intuitive UI/UX implementation and various third party API Integrations to facilitate the loan application process.

See More Case Studies

- Asp .Net Core

- MSSql

- ReactJS

- Electron JS

- Swagger

- Signal R

- Dot min for sync (Library)

- React Native

A POS System

The client has conceptualized a dynamic and adaptable point-of-sale (POS) system designed to optimize retail management operations. This comprehensive solution aims to enhance sales and inventory management efficiency, facilitate employee and customer administration, and accommodate diverse payment methods seamlessly. Notably, this POS system prioritizes customization options to suit the unique needs of businesses across different scales while ensuring seamless integration with industry-standard hardware.

Read More

- Next.js

- Laravel

- REST API

- MySQL

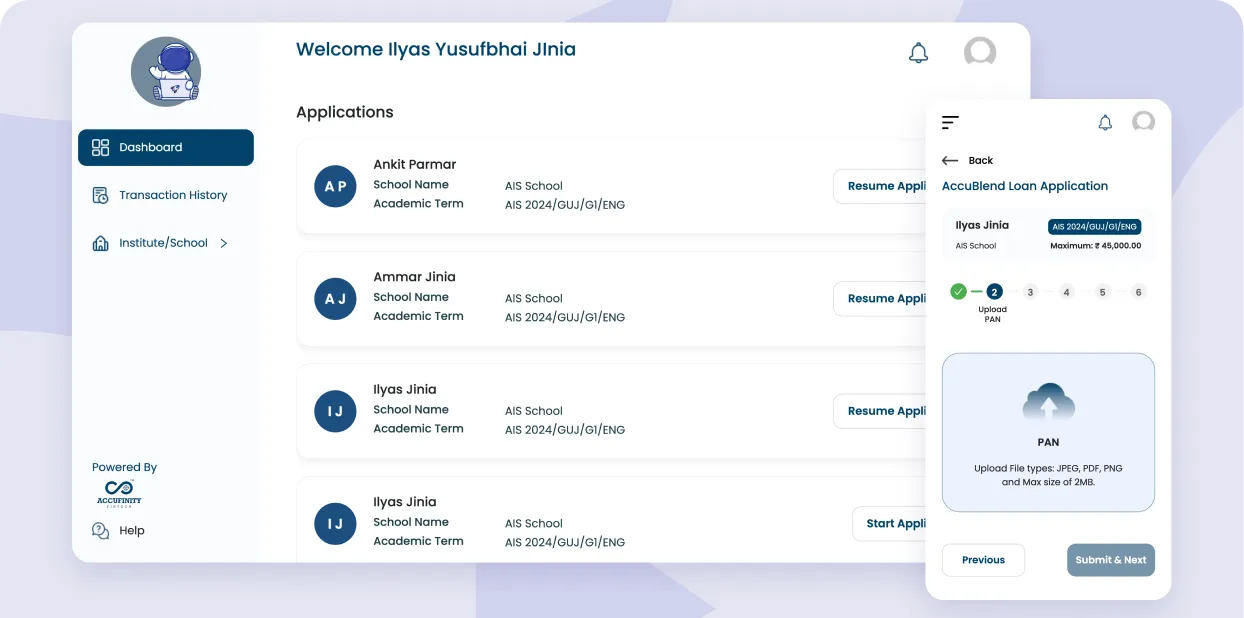

A Fintech Custom Web Application For Interest-Free EMI for School Fees

The client initiated a project aimed at transforming financial accessibility and streamlining payment processes for parents and educational institutions. The objective was to tackle the challenges encountered by both parties in managing tuition fees and financial transactions efficiently.

Read More